Admin: Corporate Admin

Page: Reports > Orders

URL: [CLIENTID].corpadmin.directscale.com/Corporate/Reports/Sales

Permission: ViewSales()

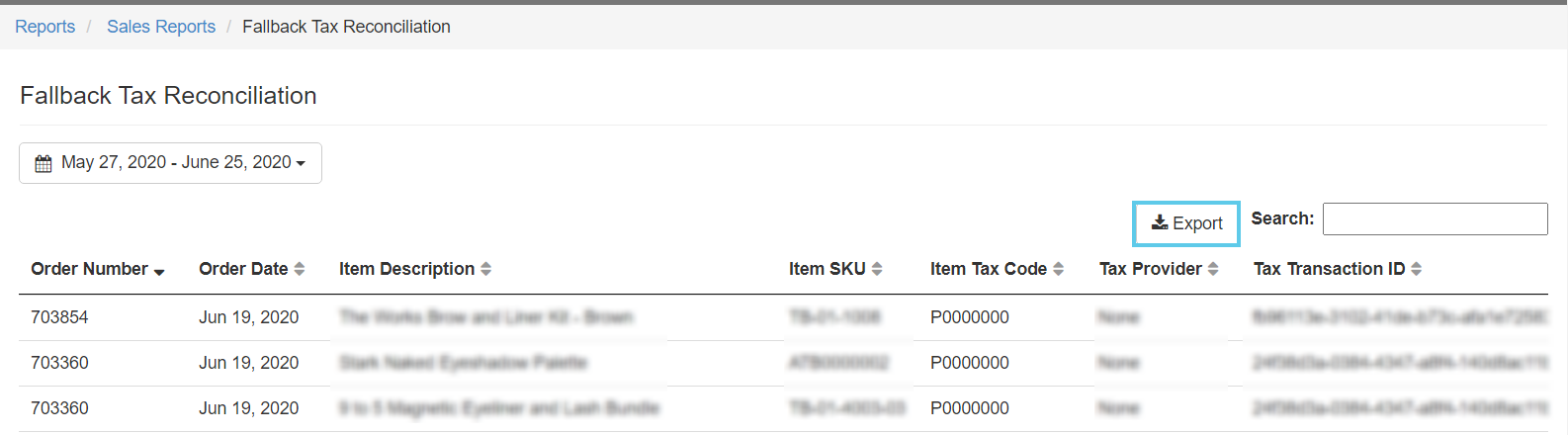

When a tax service goes down, every sale that doesn’t collect tax is recorded in the Fallback Tax Reconciliation report.

To learn how to set up the platform’s Fallback Tax Service see Setting up Tax Services.

-

Under Audit Reports, click the Fallback Tax Reconciliation report.

-

You can export the Fallback Tax Reconciliation report and open it in any spreadsheet program (Google Sheets, Microsoft Excel, etc.).

-

Click the Export button.

The report downloads as a CSV file.

-

Edit the CSV file to inspect the data.

-

Upload the file manually in your tax provider of choice’s portal to record missing transactions.

-

Comments

Please sign in to leave a comment.