The PayQuicker Platform is secure, compliant, FDIC insured, and provides customized solutions with automated payment processing to over 170 countries. Flexible spending options include co-branded prepaid debit cards, local bank deposits, cross-border payments, and spend-back.

For money-out (commission payments), PayQuicker can function as an E-Wallet where the available funds come from earned commission payouts. You can also set PayQuicker up as a payment processor (money-in) merchant to charge for orders.

Basic E-Wallet Payment Process

When an Associate receives commission payments, the system funds their E-Wallet. The funds are available to purchase more of your products.

-

The Associate selects their inventory items and begins the checkout process.

-

The Associate selects "PayQuicker" as the payment provider and clicks the Checkout button.

PayQuicker displays the Associate’s available balance here as well. A balance of "-1" means the Associate’s account is not yet set up. The Associate should contact you to resolve this issue. -

The order processing system retrieves the balance from the Associate’s account to verify funds and then sends the request to charge.

-

PayQuicker processes the request and sends back confirmation of acceptance (or denial if there are insufficient funds).

Before You Start

-

For testing on PayQuicker’s side, reach out to your account manager and gain credentials to a production site. On the DirectScale side, if you have a Stage environment, you can create test orders and commission payments there before setting up on Live.

-

You must "whitelist" your DirectScale Live and Stage IP addresses with PayQuicker. Contact Customer Care for assistance.

-

Acquire the necessary credentials and information (provided by PayQuicker when your account is created.):

-

IdP Url

-

API Client ID

-

API Client Secret

-

Funding Account Public ID

-

Adding Credentials in DirectScale

Admin: Corporate Admin

Page: Settings > Advanced Settings > Merchants

URL: [CLIENTID].corpadmin.directscale[ENVIRONMENT].com/Settings?category=Merchants

Permission: ViewAdministration(), ViewAdvancedSettings()

| For testing purposes, add credentials to your Stage environment first (if available). |

-

Scroll down until you find your PayQuicker’s form (or Ctrl F "payquicker").

-

Enter the provided credentials in the form.

Required fields:

-

Funding Account Public ID - Provided by PayQuicker.

-

API Client ID - Provided by PayQuicker.

-

API Client Secret - Provided by PayQuicker.

-

IdP URL - Provided by PayQuicker.

-

Is Live - When disabled, the merchant is in simulated transaction mode that allows you to test payments on your Stage environment. When you’re ready to start using PayQuicker to accept/payout real money, enable this setting on your Live environment.

All integrated payment merchants must have Is Live enabled on Live to function. Optional fields:

-

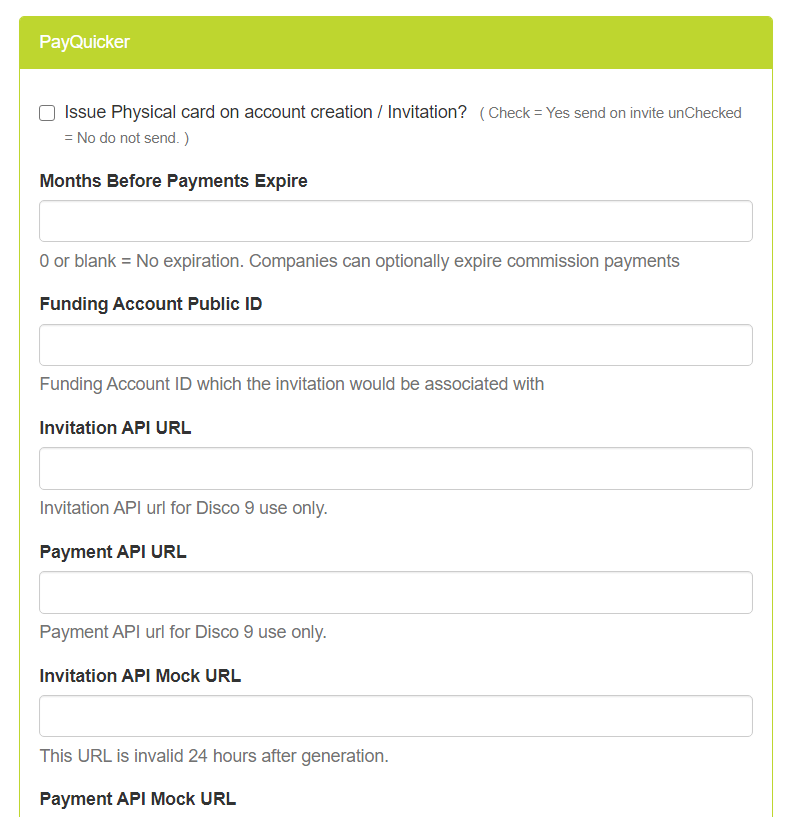

Issue Physical card on account creation / Invitation? - Enable this setting to send the Associate a physical card once their account is provisioned.

-

Months Before Payments Expire - You can optionally set the number of months that must elapse for payments to expire. Enter "0" or leave blank for no expiration.

-

Backup Merchant ID - You can optionally integrate with a second merchant provider for backup. The backup merchant’s purpose is to cover the difference if an Associate doesn’t have enough E-Wallet credit to complete a purchase.

Deprecated fields:

-

Invitation API URL

-

Payment API URL

-

Invitation API Mock URL

-

Payment API Mock URL

-

Base API URL

-

-

Click the Save Changes button.

Setting up PayQuicker as a Commissions Merchant

Admin: Corporate Admin

Page: Settings > Advanced Settings > Commission

URL: [CLIENTID].corpadmin.directscale.com/Settings?category=Commission

Permission: ViewAdministration(), ViewAdvancedSettings()

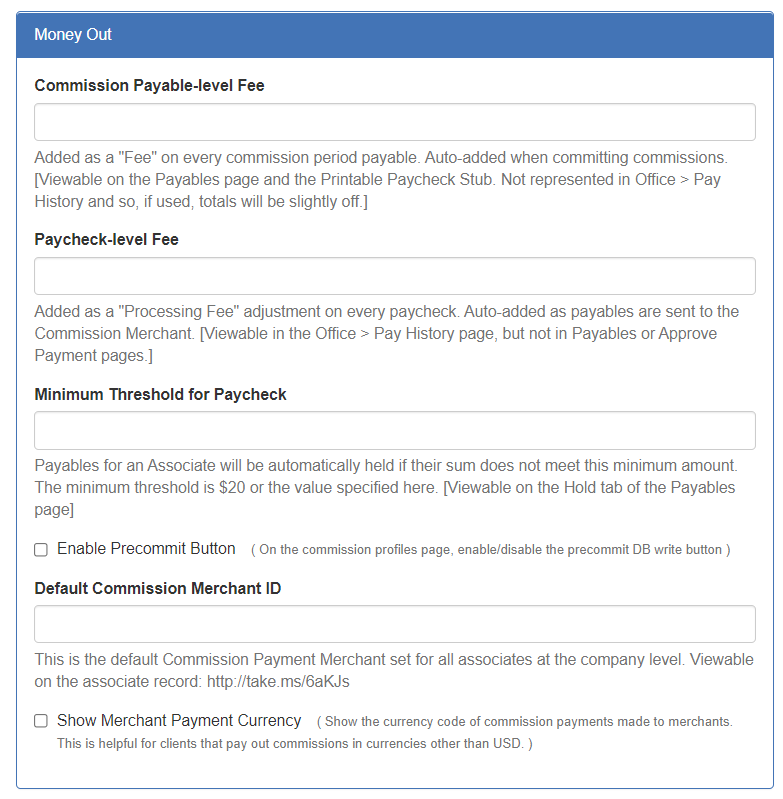

If you plan to use PayQuicker as your commissions payout merchant, you must enter the Merchant ID in Corporate Admin.

| For testing purposes, add credentials to your Stage environment first (if available). |

On Settings > Advanced Settings > Commission:

-

Locate the Money Out section.

-

In the Default Commission Merchant ID field, enter

113, PayQuicker’s Merchant ID. -

Click the Save Changes button.

Additional Settings

-

For additional commission merchant settings, see Integrating with a Commission Merchant Provider.

-

For restricting PayQuicker to specific regions or Associate Types, see Mapping Commission Merchants

Comments

Please sign in to leave a comment.