Admin: Corporate Admin

Page: Settings > Advanced Settings > Tax Providers

URL: [CLIENTID].corpadmin.directscale.com/Settings?category=Tax%20Providers

Permission: ViewAdministration(), ViewAdvancedSettings

The DirectScale Backup Tax Service (also known as a Fallback Tax Service or Fallback Tax Provider) serves as a fallback option if your integrated tax service provider is having issues. When calculating taxes, it looks at the zip code for the order and estimates the tax amount using our internal tax tables.

| The DirectScale Backup Tax Service should be a fallback option only. The taxes calculated can not be guaranteed to be 100% correct. You must integrate with a third-party tax services provider. Read more in Setting up Tax Services. |

| The DirectScale Backup Tax Service only works for United States tax collection. |

To set up:

-

Navigate to Settings > Advanced Settings > Tax Providers.

-

Locate the Tax Error Behavior section.

-

Click the dropdown and select DirectScale Backup Tax Service.

-

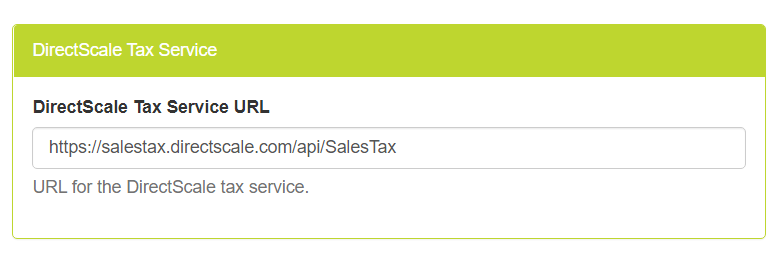

Locate the DirectScale Tax Service section and enter the following URL in the field:

https://salestax.directscale.com/api/SalesTax

-

Click Save Changes.

| If the zip code on the order isn’t valid, then no taxes will be collected. |

When configured and an error occurs, this backup option will collect tax, and the sale will display on the Fallback Tax Reconciliation Report.

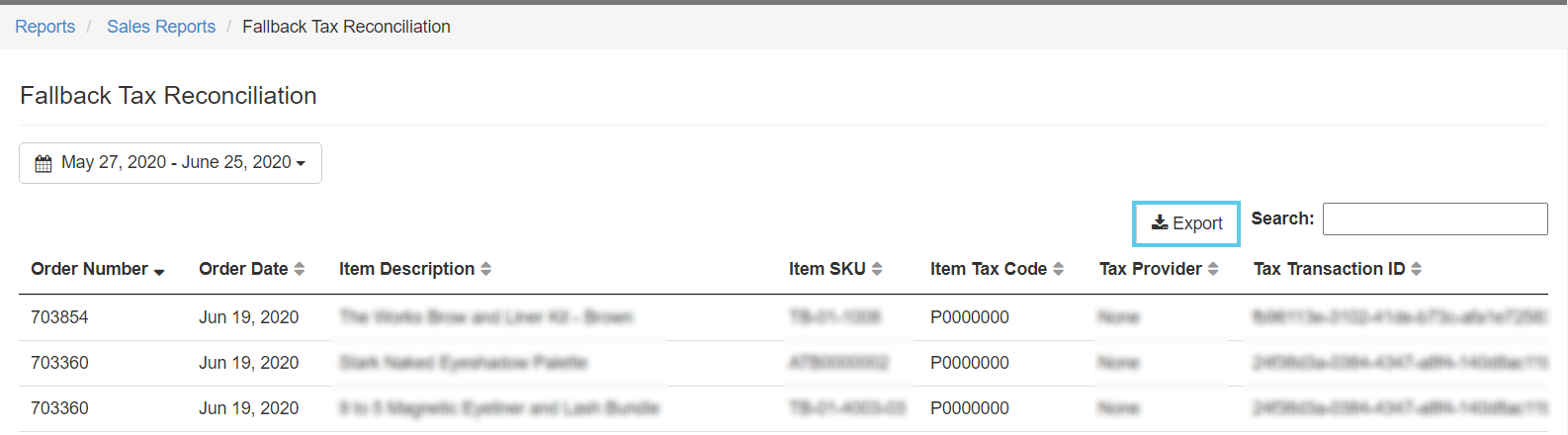

Viewing the Fallback Tax Reconciliation Report

Admin: Corporate Admin

Page: Reports > Orders

URL: [CLIENTID].corpadmin.directscale.com/Corporate/Reports/Sales

Permission: ViewSales()

Every sale that doesn’t collect tax is recorded in the Fallback Tax Reconciliation Report when a tax service goes down.

-

Navigate to Reports > Orders.

-

Under Audit Reports, click the Fallback Tax Reconciliation Report.

You can export the Fallback Tax Reconciliation Report and open it in any spreadsheet program (Google Sheets, Microsoft Excel, etc.):

-

Click the Export button.

The report downloads as a CSV file.

-

Edit the CSV file to inspect the data.

-

Upload the file manually in your tax provider of choice’s portal to record missing transactions.

Comments

Please sign in to leave a comment.