Admin: Corporate Admin

Page: Commissions > Payables

URL: [CLIENTID].corpadmin.directscale.com/Corporate/CRM/Commissions/ManagePayables

Permission: ViewCommissions(), ViewPayables()

After reviewing payables, you can use the Import from file feature for mass payable Adjustments. You can download a CSV template file to your computer. Then complete the template, save it, and upload it.

Downloading the File

-

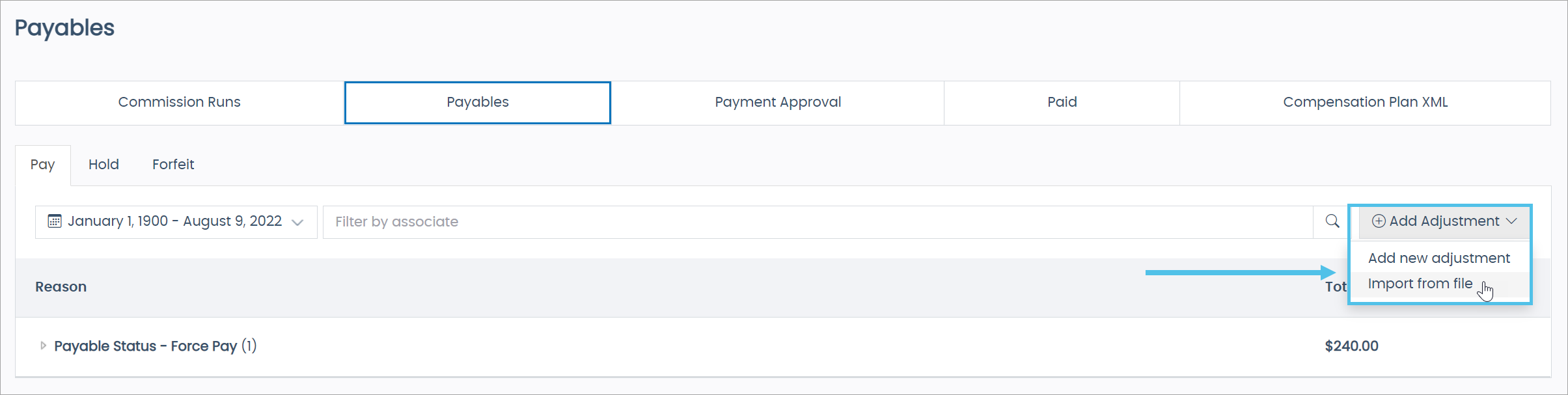

In the Pay tab, click the Add Adjustment button and select Import from file.

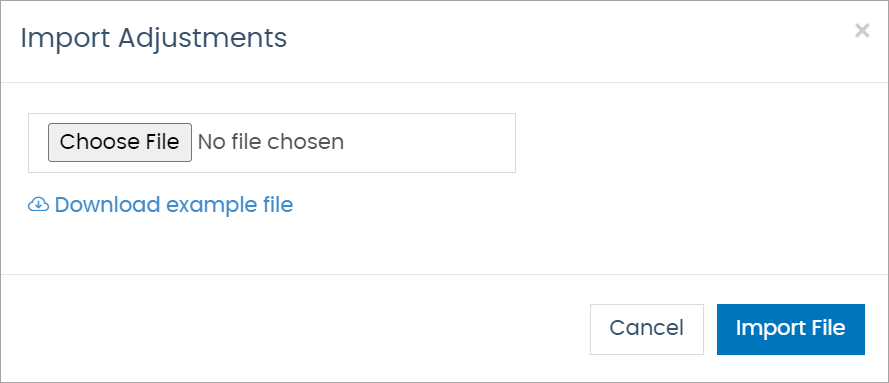

The Import Adjustments pop-up window opens.

-

Click Download example file.

An Adjustment Template downloads to your computer.

-

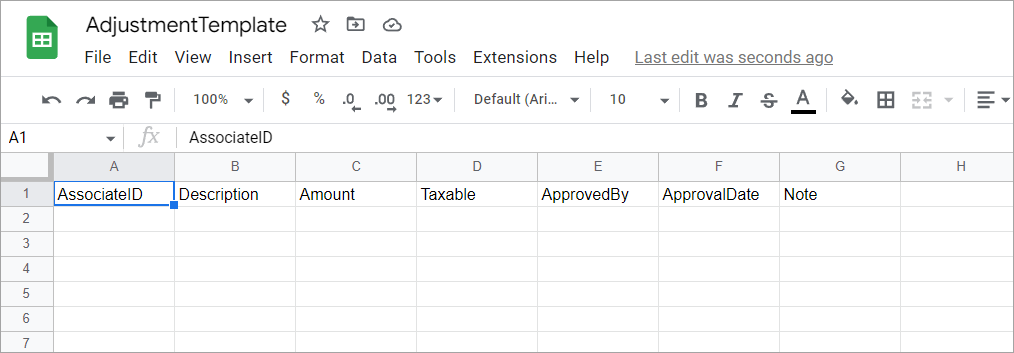

Open the downloaded CSV file in a spreadsheet program, such as Microsoft Excel or Google Sheets.

-

Add the adjustment information in the appropriate columns.

-

AssociateID - The ID of the Associate who will receive the adjustment.

-

Description - A description of the change.

-

Amount - The amount to adjust. It can be positive or negative.

-

Taxable - Is the amount taxable or not?

-

Yes - The income is considered taxable on the Associate’s 1099.

-

No - The income is not considered taxable on the Associate’s 1099.

-

-

ApprovedBy - The name of the employee who approves the change.

-

ApprovalDate - The date of the approval.

-

Note - Enter any additional notes about the change.

-

-

Save the file.

Uploading the File

-

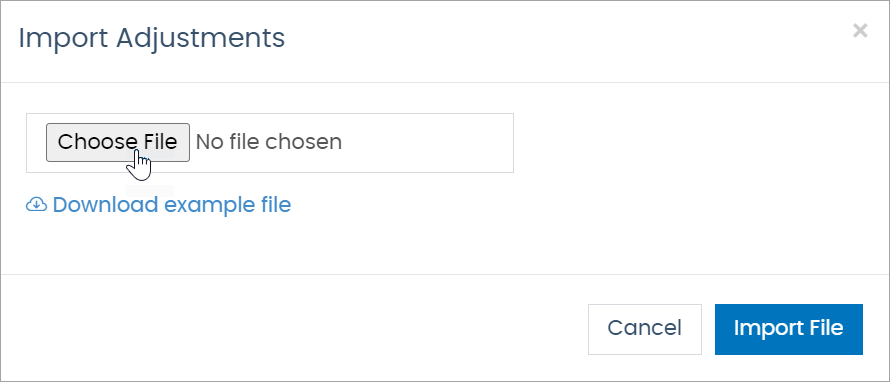

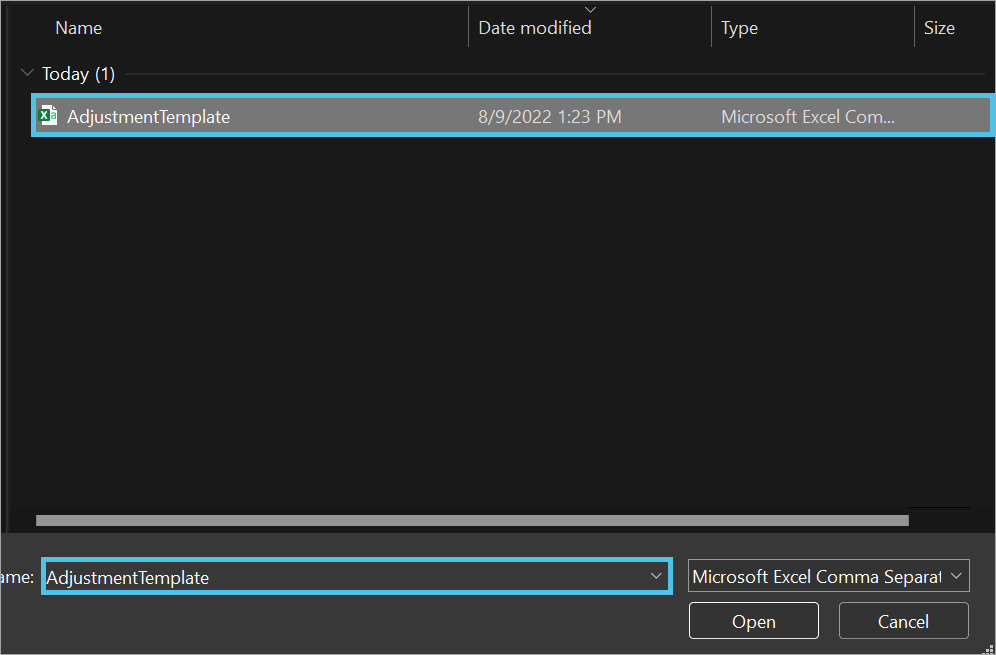

On the Payables page Import Adjustments pop-up window, click Choose File.

-

Select the saved Adjustment file from your computer.

The file begins to upload.

Once you upload the file, the results will appear under the Pay tab with the Payable Status — Force Pay status.

Troubleshooting

If there are errors in the file or missing fields, you will receive an error notification. To correct the errors:

-

Fix and re-save the file.

-

Then re-upload.

Comments

Please sign in to leave a comment.