This article will show you how to integrate your system with a tax services provider. Integrating involves entering credentials given to you by your tax services provider and adding their specific tax codes. Once integrated, you’ll be able to calculate tax for orders and subscriptions.

Creating an Account with a Tax Service Provider

The first step in integration is to contact a tax services provider and create an account. Once your account is set up, you’ll need your account credentials. Each tax provider form has a unique set of authentication fields. Work with your tax provider or contact customer care for assistance in obtaining the correct credentials.

The payment providers integrated with Corporate Admin by default are:

✨ Starter Tier must use the preferred providers listed. For Business and Premium Tiers, if a provider is not on the list you want to use, a solution provider can custom develop an integration. Contact Customer Care for more details.

| Visit the DirectScale Marketplace to find additional provider apps and integrations that will help your business grow. |

Entering Provider Credentials

Admin: Corporate Admin

Page: Settings > Advanced Settings > Tax Providers

URL: [CLIENTID].corpadmin.directscale.com/Settings?category=Tax%20Providers

Permission: ViewAdministration(), ViewAdvancedSettings

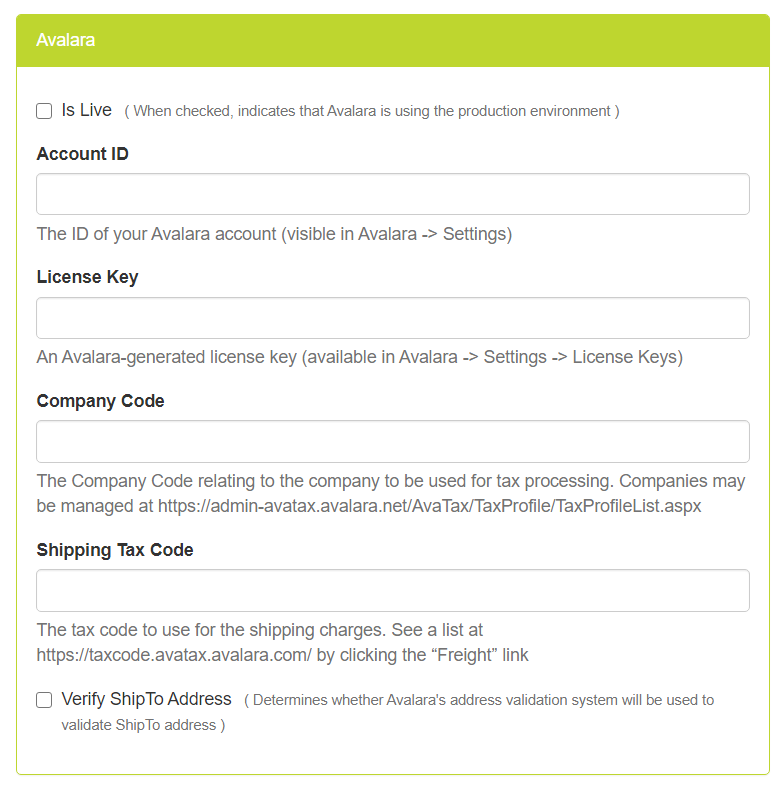

On the Tax Providers page, you’ll see a host of different tax provider forms. Locate your chosen provider and enter the credentials.

-

Scroll down until you find your tax provider’s section.

-

Enter the credentials provided by your tax provider in the form.

-

Scroll down and locate the Tax Provider section.

-

Select your tax provider of choice in the dropdown.

-

Click the Save Changes button.

While entering your credentials, we highly recommend that you select how the system reacts when the tax provider either does not respond or encounters a critical error.

-

In the Tax Error Behavior section, click the dropdown to reveal three options:

-

Display Tax Error - Displays an error if the tax service is down.

-

No Tax Collected - The tax rate will display as zero, and the order will collect no tax for the order.

This option is recommended for those who have foreign tax collections. Because no taxes are collected from the customer, your company will be liable for the tax revenue. -

DirectScale Backup Tax Service - The service will calculate the tax rate by taking the customer’s zip code and estimating the tax rate.

If you select this option, locate the DirectScale Tax Service section and enter the following URL in the field:

https://salestax.directscale.com/api/SalesTax.For more information, see Setting up the DirectScale Backup Tax Service.

This option is recommended for those who have only US tax collections, as this option doesn’t work outside the United States.

-

-

Click Save Changes.

Comments

Please sign in to leave a comment.