Back to Testing Checklist

After going through the checklists in the Get Started section and integrating with a Tax Service Provider, you’ll want to ensure taxes correctly appear when creating a Corporate Shop, Web Office, and eCommerce Shop order.

-

Do this in your Live environment.

-

Do this for each of your Stores (mainly Corporate, Wholesale, Retail).

-

Do this for every market you have set up.

| Report any errors you find to Customer Care or your DirectScale contact. |

Before You Start

-

Set up your tax integration on your Live environment.

For Corporate Admin

-

Using your test Associate, create an order in the Corporate Shop.

-

Add an item to the cart and navigate to the Checkout page.

-

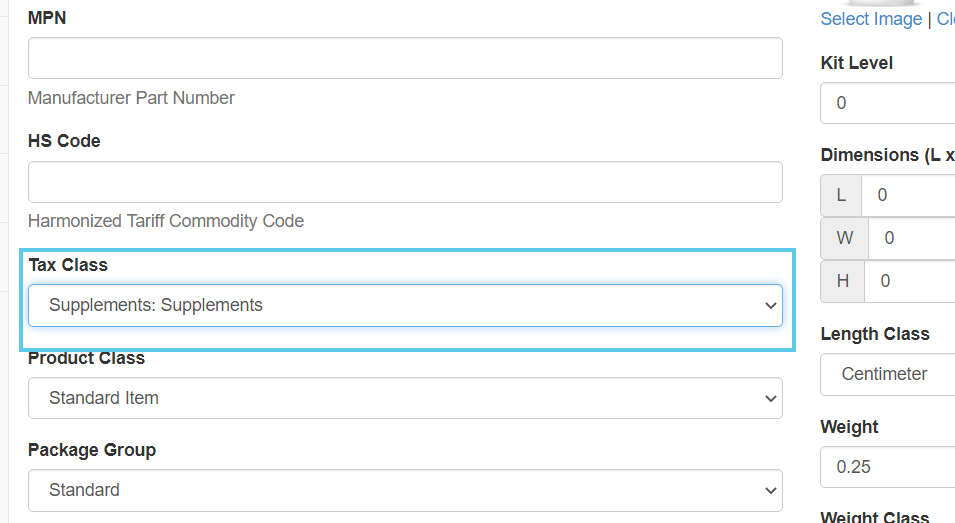

Ensure your inventory items all have the correct Tax Class selected.

For Web Office

-

Using your test Associate, create an order in the Web Office.

-

Add an item to the cart and navigate to the Checkout page.

-

The TAX amount appears above the ORDER TOTAL.

For eCommerce Shop

-

Using your test Associate, create an order in the eCommerce Shop.

-

Add an item to the cart and navigate to the Checkout page.

-

The Tax Total amount appears above the Total.

Testing with Your Provider

You should now check your tax provider software to ensure the transactions appear correctly in their system.

-

Create orders in DirectScale.

-

Log in to your tax provider’s portal.

-

Check the tax amounts.

If there are any errors, you may need to contact both Customer Care and your tax provider’s support to locate which side the problem is occurring.

Comments

Please sign in to leave a comment.