Admin: Corporate Admin

Page: Tools > Overrides

URL: [CLIENTID].corpadmin.directscale.com/Corporate/CRM/RankOverride

Permission: ViewCommissions(), ViewOverrides()

You can override the commission amounts at any time. This includes overriding ranks, options (or Rules), and bonuses. Overrides are distinct from Adjustments, which are post-commit and tied to paychecks.

Override Types

-

Rank Override — Override the Rank at which you pay an Associate.

-

Option/Rule Override — Override a commission Rule for an Associate.

-

Bonus Override — Adding a new bonus for an Associate’s commission payout. This shows up in an Associate’s Bonus Detail breakdown in their Web Office Commission History and Pay History, as well as in the Associate’s Detail > Commissions page.

Adding an Override

| Before adding new Overrides, select the period it applies to with the Period Selector. |

-

Click the Add Override button.

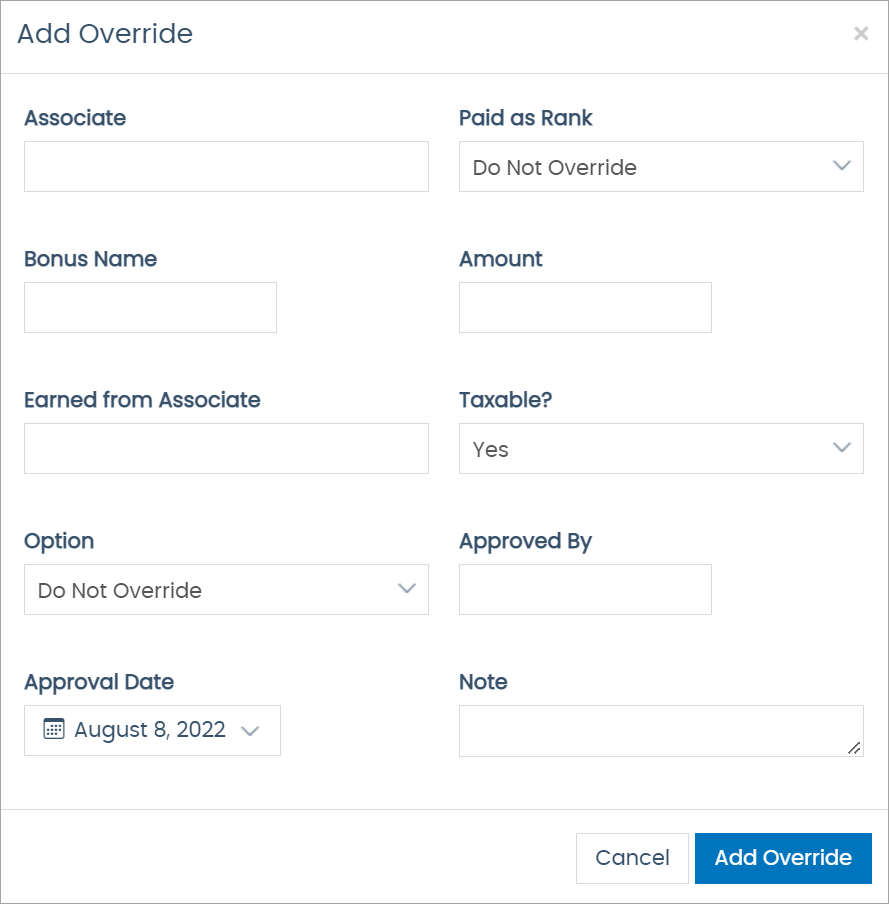

The Add Override pop-up window opens.

Not every field is required. Complete the form using the relevant fields needed for the Override. If the selected period is still open, the pop-up will have two more drop-downs:

-

Option

-

Paid as Rank

-

-

In the pop-up, enter the receiving Associate's name or ID.

-

Select the Rank level to pay the Associate with the Paid as Rank drop-down.

-

If applicable, enter the Bonus Name. If not, continue to the next step.

For best results, enter a name with no slashes or special characters.

The name cannot contain the following special characters:

-

< (less than)

-

> (greater than)

-

: (colon)

-

" (double quote)

-

/ (forward slash)

-

\ (backslash)

-

| (vertical bar or pipe)

-

? (question mark)

-

* (asterisk)

Enter the Bonus Name exactly as it appears in your compensation plan. For example, if the bonus name is "Personal Enrollment Bonus — 30 Days" and you enter "Personal Enrollment Bonus — 30 Days", it will display as a second bonus in the Web Office. -

-

Enter the dollar amount bonus in the Amount field.

-

In the Taxable drop-down, select whether the bonus is taxable or not.

-

Yes - The Override income is considered taxable on the Associate’s 1099.

-

No - The Override income is not considered taxable on the Associate’s 1099.

-

-

Enter the name of Earned from Associate. This is the Associate from whom the overridden Associate earned the bonus.

-

Click the Option drop-down, and select the relevant Override.

Rank, bonuses, and options (which are criteria for Rank qualification) can have Overrides. For example, the Has 75 CV option will have an Override so that the Associate will meet this Rank criterion regardless of any CV in the organization.

-

In the Approved By field, type the Admin’s name who approves of the Override.

-

In the Note field, type a note or description of the Override if applicable.

-

Select Approved Date for the Override.

This approval date should be in the commission period the Override takes place.

-

When finished, click Add Override.

When you add Overrides, it’s recorded in the Service Log on the Associate’s Detail page.

Importing Overrides

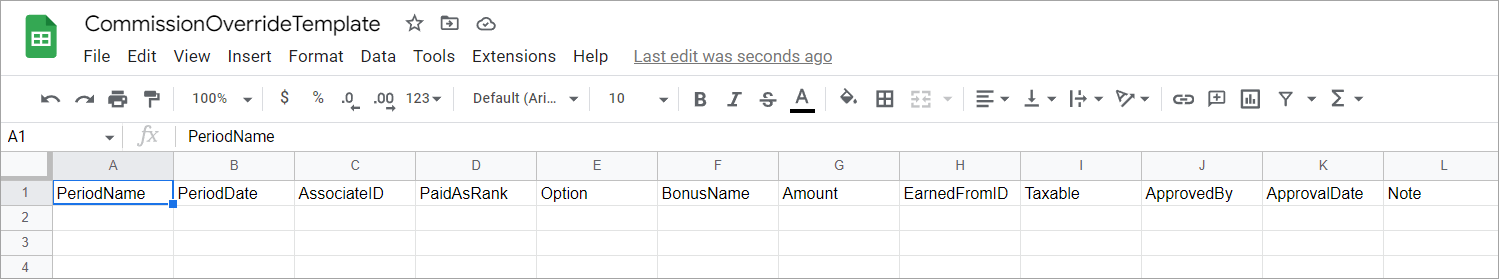

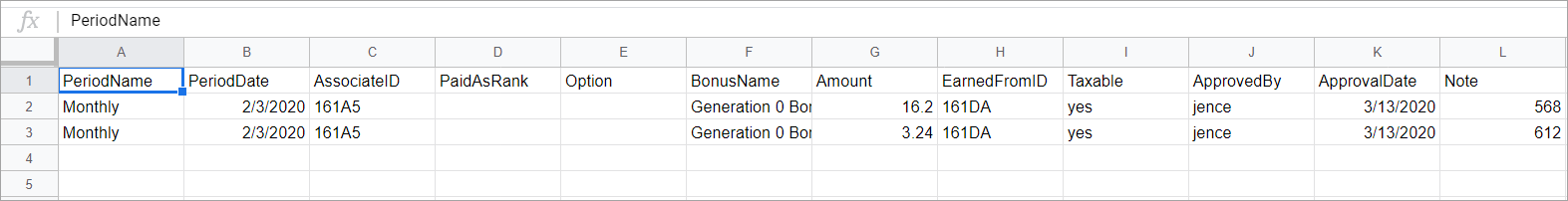

You can add an Override by importing a completed CSV template file. The template contains column headings matching the fields in the Add Override pop-up. Open the CSV in spreadsheet software, such as Microsoft Excel or Google Sheets.

The following are some definitions of the columns in the template file.

| Not all Override types use all fields. |

-

PeriodName - Enter commission period name (Monthly or Weekly).

-

PeriodDate - Enter the start date of the period.

-

AssociateID - Enter the ID of the Associate to receive the Override. You can find this ID on their Detail Summary page.

-

PaidAsRank - Enter the Rank at which to pay the Associate.

-

Option - Enter the bonus option.

-

BonusName - Enter the bonus name.

For best results, enter a name with no slashes or special characters.

The name cannot contain the following special characters:

-

< (less than)

-

> (greater than)

-

: (colon)

-

" (double quote)

-

/ (forward slash)

-

\ (backslash)

-

| (vertical bar or pipe)

-

? (question mark)

-

* (asterisk)

Enter the Bonus Name exactly as it appears in your compensation plan. For example, if the bonus name is "Personal Enrollment Bonus — 30 Days" and you enter "Personal Enrollment Bonus — 30 Days", it will display as a second bonus in the Web Office. -

-

Amount - Enter a decimal dollar amount to apply a bonus.

-

EarnedFromID - Enter the Associate ID from which the to-be-overridden Associate earned this bonus.

-

Taxable - Select whether the bonus is taxable or not.

-

Yes - The Override income is considered taxable on the Associate’s 1099.

-

No - The Override income is not considered taxable on the Associate’s 1099.

-

-

ApprovedBy - Type the name of the Associate who approves the Override.

-

ApprovalDate - Enter the date of approval.

-

Note - Type any necessary notes.

To import an Override:

-

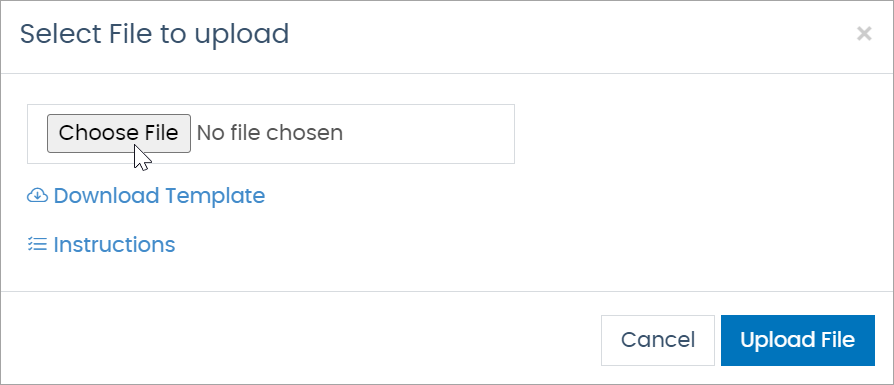

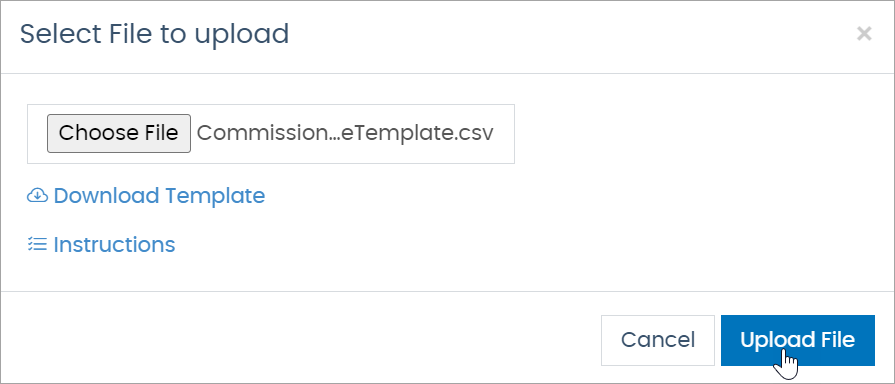

Click the Import button.

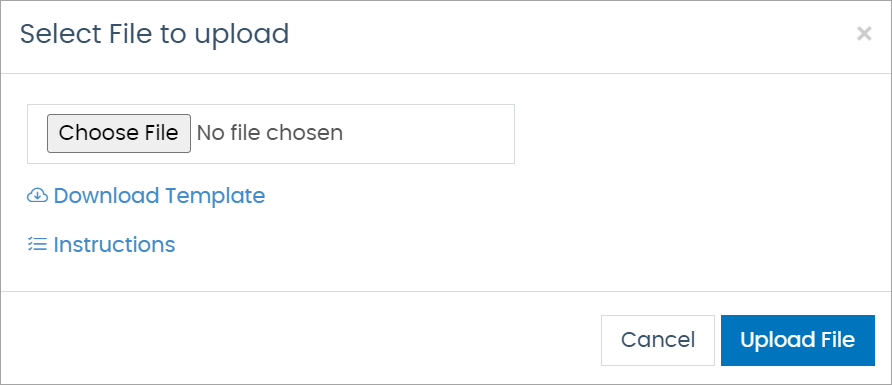

The Select File to upload pop-up window opens.

-

In the pop-up, click Download Template.

CommissionOverrideTemplate.csvdownloads. -

Open the downloaded template in your spreadsheet program of choice (Microsoft Excel, Google Sheets, Apple Numbers, etc.).

-

In the spreadsheet program, enter your data in the fields under the relevant columns.

Save the file to your computer.

-

Back on the Overrides page, in the Select File to upload pop-up, click Choose File to upload your complete template.

Your computer’s file finder opens. Navigate to the saved template and click Open.

-

Click Upload File.

Giving a Bonus Override

Granting a Bonus Override will add a new line to the Associate’s Bonus Detail breakdown in their

For example, the Bonus Override inserts a new line item detail into that bonus. Suppose Associate X earned $100 on a particular bonus. This bonus is from five separate downline Associates (earning $20 each). When you add a $30 Bonus Override, the new total bonus amount would be $130. Associate X will see they earned $130 on that bonus from six separate downline Associates.

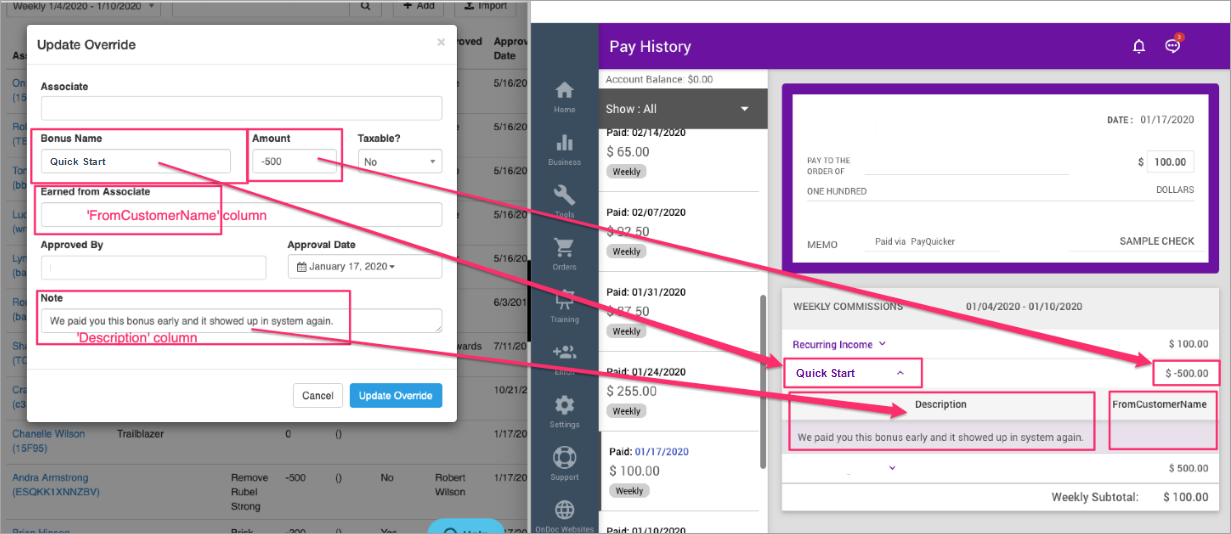

Viewing in the Web Office

An Associate can view their Bonus Overrides in their Pay History and Commissions reports in Web Office.

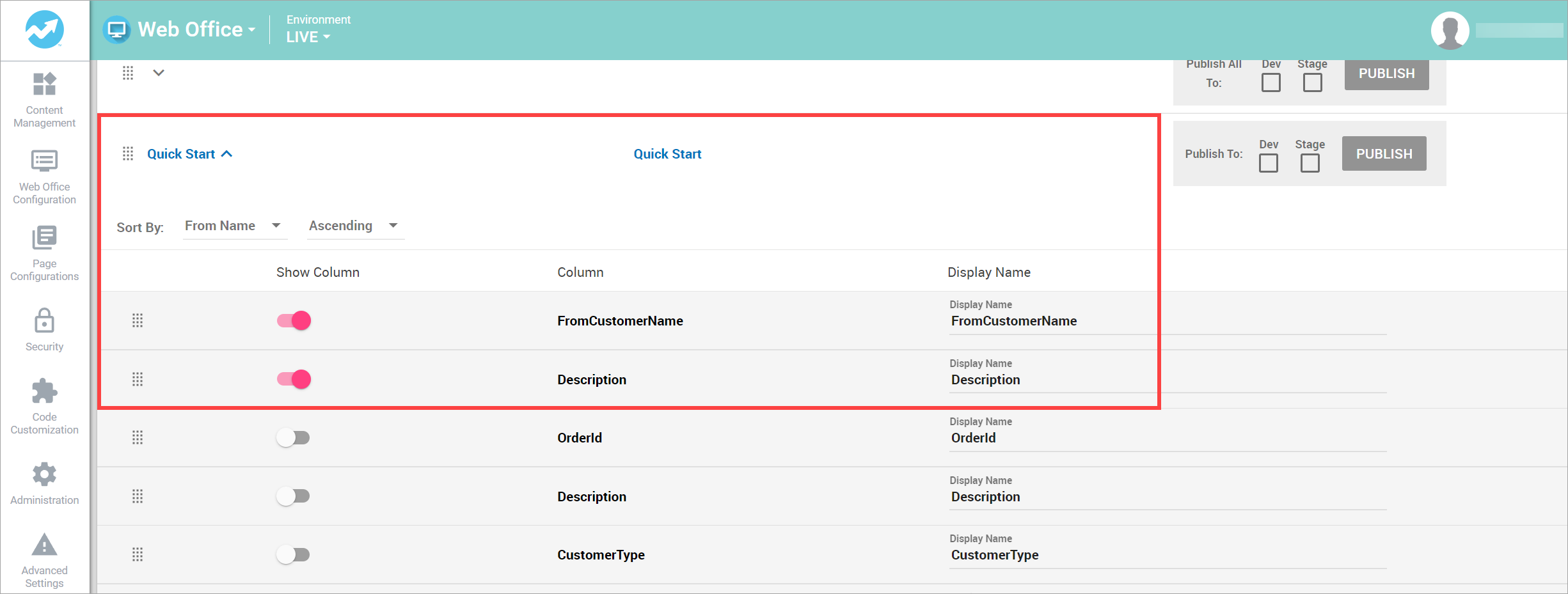

You can customize the Pay History report columns with the Web Office Admin > Web Office Configuration > Commission & Pay History page. For Bonus Overrides, you only need the Description and FromCustomerName columns enabled.

The following shows how the fields in the Add Override pop-up window appear in the report:

-

Bonus Name = Commission group

-

Amount = AmountPaid

-

Earned from Associate = FromCustomerName column

-

Note = Description column

| These Overrides only show in the Pay History and Commissions reports if the Override type includes a +/- in the Amount field. Other Overrides, such as Rank, aren’t displayed. |

Seeing the New Amounts

After adding Overrides, create a new commission profile to see the new amounts reflected.

Comments

Please sign in to leave a comment.